REVIEWER

Enhancing restaurant review management software through interactive performance metrics

.png)

PROBLEM

Restaurants lack an effective tool for consolidating and

interpreting reviews

Research highlights the critical importance of reviews in shaping a restaurant's reputation and overall business success. During my time as a server, I identified the need to address the time-consuming and inefficient process of analyzing and compiling review insights. In response, I designed "Reviewer," a review management software that introduces interactive performance metric modules for swift identification of business performance and effective communication with staff.

SOLUTION

Interactive metrics for quick and efficient action

This dashboard features an interactive overview section that provides managers with real-time customer satisfaction insights across multiple review platforms, enabling targeted actions. Additionally, it allows managers to delve deeper into individual reviews through a detailed review interface.

O1 OVERVIEW PAGE

Reduce visual clutter to empower analysis

-

Reduce visual clutter of all performance metrics for a cleaner, more intuitive interface.

-

Utilize interactive modules for quick, visually engaging presentations to staff.

-

Filter and focus on critical performance indicators to design targeted, effective strategies.

O2 REVIEWS TAB

Provide context into who, what, and why

-

Contextualize user sentiment by reading the exact reviews provided by customers

-

Search and filter reviews by sentiment, text, time and review platform.

-

Highlight staff members to understand individual performance across time.

SOLUTION

RESEARCH

Extensive time and effort is required to gain deeper insights across competitors

I began by analyzing top competitors in the review management space through user reviews and feature capabilities. I quickly discovered that users were frustrated by the time it took to sift through reviews and uncover insights. Despite having similar features, none of the platforms offered a quick and interactive way for users to engage with their data without having to put time and effort into building a custom dashboard.

In analyzing user reviews, I developed a user persona that best embodied my target audience's motivations, goals, and frustrations.

_edited.png)

SOLUTION

After compiling all the key insights from the competitive analysis and user reviews, I was able to better understand the underlying issues users had. My analysis led me to 2 key pain points that needed to be addressed.

Difficulty compiling and analyzing reviews across platforms

Business owners and managers struggle to identify key trends in customer sentiment due to fragmented data across platforms and information overload, leading to missed insights and delayed action.

Insights buried in complexity

Business owners and managers find it challenging to extract meaningful insights from complex review platforms. High-level dashboards are often vague and lack interactivity, forcing users to create custom views just to access the information they need.

DESIGN PROCESS

Defining key metrics & prioritizing information hierarchy

Upon identifying the key pain points I went back to review the competitors in the space and analyzed which key metrics users deemed important. I employed affinity mapping to layout numerous metrics users mentioned, while also evaluating opportunities to combine or simplify similar metrics.

Hover to View Groupings

Overall Average

Rating

Satisfaction or Reputation Score

Benchmarking against industry/local average

Score change

overtime

Number & % of

reviews by rating

Total number

of reviews

Number of reviews mentioning staff

Review rating

per dish

Recent to YTD

reviews

Reviews over time

Review Sentiment

(Positive/Negative)

% of positive/negative reviews

Average rating by platform (i.e Google)

Number of reviews

on a given day

Review rating per location

Frequency of positive

& negative reviews

Read reviews by sentiment

Reviews by customer segment type

Number of reviews by sentiment

Keyword

identification

Review length

Repeat reviewers

Reviews by location

Review Overview

Reputation Score / Benchmarking

Review Tracking

Filter Capabilities

Sentient Outlook

Hard to Track / Unnecessary

First time reviewers

Net Promoter Score

Reviews leading to reservations

Like or thumbs up

on reviews

Customer effort score (ease of use)

Review response

rates

Average response

times

Once I uncovered what type of metrics users would come to expect on an overview section I surveyed 8 participants to gain a better understanding on the importance of each metric to ensure strong information hierarchy.

Card Sort

Assume the role of a restaurant manager assessing business performance via customer reviews. Rank the following metrics by importance. Rank 4 - Least important to Rank 1 - Most important

SOLUTION

With a clear understanding of the information users valued most, I began iterating on design solutions. Through multiple rounds of exploration—including module layouts, data visualizations, and interactive prototypes—I refined the information hierarchy to prioritize clarity and usability. The final design streamlined the user experience, ultimately reducing the time it took to surface actionable insights.

Overview Page Layout

I began by creating basic grid layouts to map the placement of individual modules and sketching out potential interactions. This allowed me to quickly define the overall structure of the interface before investing time in chart design and data visualization.

.png)

Interaction: Accordion style dropdown - expanding to dive deeper into metric

01. Large Accordion Modules w/ Dropdown Interaction

02. Small Key Metric Modules w/ Expandable Capability

Interaction: Ability to click to view deeper insights - expands module

Key Metrics

Scrollable

Interaction: Toggle on interactivity - allows for modules to be clickable and then opens a pop-up

Navigation panel - allows for a different menu for full list of reviews

Navigation panel - allows for a different menu for full list of reviews

Larger modules for most important metrics

03. Larger Key Metric Modules w/ Interactivity Toggle

Simple, linear structure. Easy for users to scroll through.

Clean separation of modules reduces visual clutter.

Inefficient for providing a quick overview of metrics due to excessive scrolling.

Lacks immediate visual prioritization as all modules look equal in size.

Prioritize key metrics at the top, supporting quick decision making

Expandable modules introduce progressive disclosure - users can dive deeper only when needed.

Dense layout—smaller card sizes may compromise readability and limit what can be displayed clearly.

Prioritize key metrics at the top, supporting quick decision making

Toggle for interactivity gives users control over engagement depth—ideal for both quick scans and deep dives.

Pop-up interaction keeps users in context, avoiding page reloads or disruptive navigation.

Interactivity toggle may not be immediately intuitive—requires subtle onboarding or UI cues.

I selected Option 3 because it directly addresses both core user pain points.

By allocating more space to key metric modules, this layout helps users quickly identify important trends without being overwhelmed by fragmented data, tackling the issue of compiling and analyzing reviews across platforms. Additionally, the interactivity toggle empowers users to explore deeper insights only when needed, reducing complexity and preventing information overload. This balance of clarity and control ensures that users can surface meaningful insights effortlessly, without the need to build custom dashboards.

Modules - Data Visulizations

When designing the modules and data visualizations, I focused on usability—ensuring key metrics were immediately scannable while still providing enough supporting data to uncover trends and invite deeper exploration, all without overwhelming the user.

REVIEW OVERVIEW MODULE

_edited.jpg)

I moved forward with version 2 for its clear visual hierarchy—prioritizing the average score for quick scanning while keeping contextual details visible. To reduce visual noise, I minimized the bar chart and leveraged a pop-up for deeper exploration of rating distribution.

Greater detail - Percentage + Review Count

Increased white space - visual simpliification

Greater emphasis on key metrics

POP-UP

_edited.jpg)

Maintains metrics seen on module reducing confusion

Filtering capabilities to dive deeper into results

Larger distribution view to quickly see at what level your views peak

REPUTATION SCORE MODULE

I emphasized individual platform scores in the Reputation Score module version 2 so users can instantly spot what kind of customer each channel provides. While slightly denser visually, it provides valuable comparison data up front. The pop‑up expands on this by revealing deeper sentiment insights on demand, keeping the main view clean and focused.

_edited.jpg)

Prioritize focus on competitors as well as gaining insight into each platforms respective rating

Ability to compare against overall ovearge

POP-UP

_edited.jpg)

Dives deeper into metric by showcasing change over time

Filtering capabilities to dive deeper into results

Provides insight into the drivers of the reputation score by showcase key themes in client sentiment

REVIEW TRACKING MODULE

_edited.jpg)

Removed unneccessary bars and metrics reducing noise and improving the ability to quickly scan the chart

To help users quickly identify trends over time, I chose version 2 of the Review Tracking module for its clear, time-based visualization. It surfaces shifts in review frequency and with the added pop-up the sentiment chart adds depth on demand, supporting exploration without overwhelming the dashboard.

POP-UP

_edited.jpg)

Area chart chasing sentiment distribution

Filtering capabilities to dive deeper into results

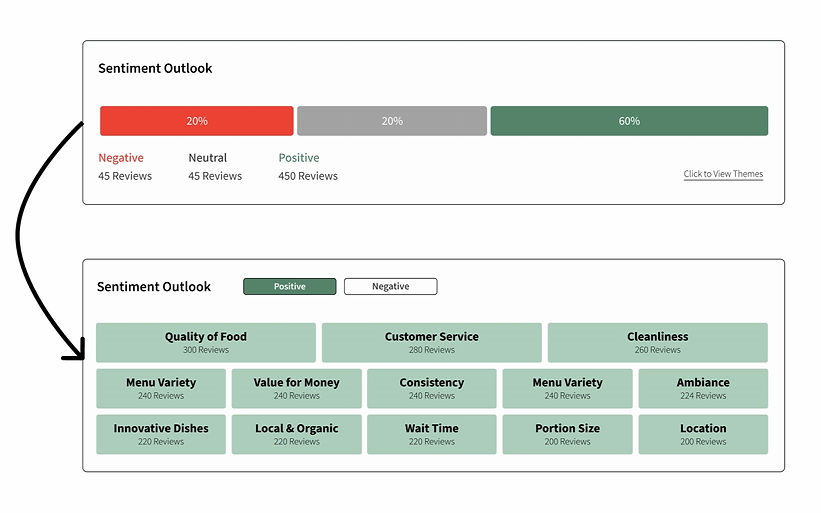

SENTIMENT OUTLOOK MODULE

_edited_edited.jpg)

Kept the ability to see both Positive and Negative sentiment but introduced them as filters to isolate each view

To make customer sentiment more actionable, I chose version 2 to surface common themes across both negative and positive sentiment. By visualizing sentiment breakdowns across categories instead of through a simple bar chart, users can quickly spot recurring issues or strengths—without needing to read each review manually. However, if they seek to read each review manually they have the option to interact with each theme independently.

Hover treatment so that once interactivity is enabled users can click into it to view all open-ended quotes that fall into theme

POP-UP

_edited.jpg)

Filtering capabilities to dive deeper into results

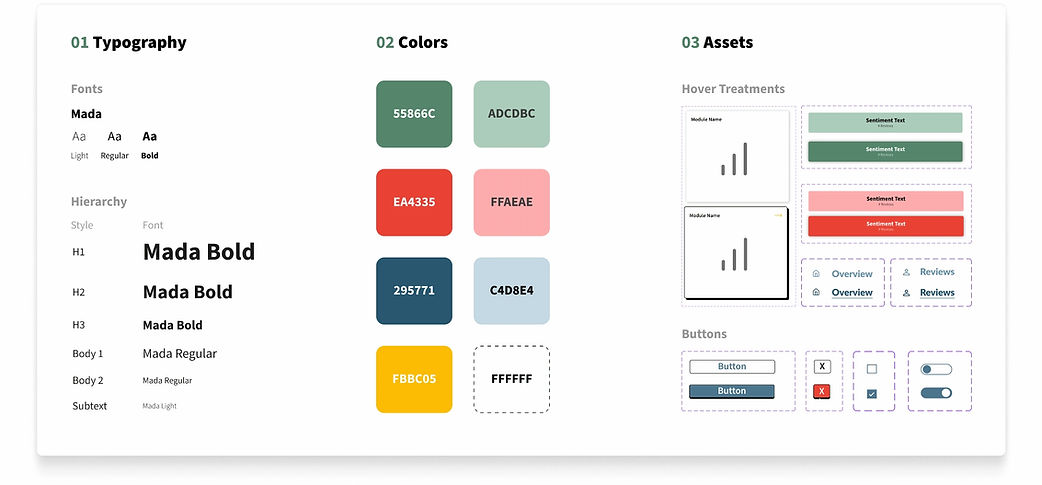

Design Kit

_edited.jpg)

FINAL DESIGN

REFLECTION

O1

O2

O3

Managing Information Overload

Designing a dashboard involves more than just displaying data—it's about making complex information digestible and actionable. The challenge I faced was managing information overload, as dashboards often present a large volume of metrics that can overwhelm users. With an RMS generating numerous summary metrics, I needed to find a way to filter and synthesize this data effectively. My solution involved prioritizing key metrics and creating clear, intuitive layouts that allowed users to easily navigate through the data, enabling them to quickly investigate and extract insights without feeling overwhelmed.

Targeting Two Pain Points

My goal for this case study was to design a product from scratch, drawing inspiration from existing review management software. However, I quickly realized that while I had many ideas for new capabilities, it was crucial to narrow my focus. I decided to center my design around addressing the user's primary pain points: dashboard intuitiveness and speed to insights. To do this, I began by reviewing user feedback to identify the core issue and ensure that my product design would directly address this pain point, leading to a more effective and targeted solution.

Future Product Development

While my current design focused on addressing the primary pain point identified through user research, I want to recognize some smaller enhancements that could be explored in future iterations. One idea is creating an AI tab, enabling users to interact with AI to draw key conclusions and guide next steps for tackling specific problems. Another idea is developing a custom module that would allow users to create and pin their own custom metrics to the overview dashboard, providing a more personalized and flexible experience.

AI MOCK-UPS

Testing AI's capabilities on mock-up production

With AI evolving so quickly, I wanted to explore how effective it could be in generating rough mock-ups for the future product ideas I outlined above, and useful it could be when integrated into UX design workflows.

O1

AI Analytics Assistant

AI Prompt

Recreate the current analytics/dashboard screen and add an AI assistant side panel on the right. The AI panel should look like a conversational chat interface where users can ask questions about the data and receive clear, concise explanations. The AI assistant should also surface ‘Solution Recommendations’ as cards or callouts based on the data shown on the screen.

*Mock-up produced using FigmaMake

_edited.jpg)

O2

Custom Module Creater

AI Prompt

Recreate this screen with a new ‘Create Custom Module’ panel. The panel should allow users to import their own data, preview the data, choose a visualization type, and save the module. The final module should be pinnable to their dashboard for quick access.

*Mock-up produced using FigmaMake